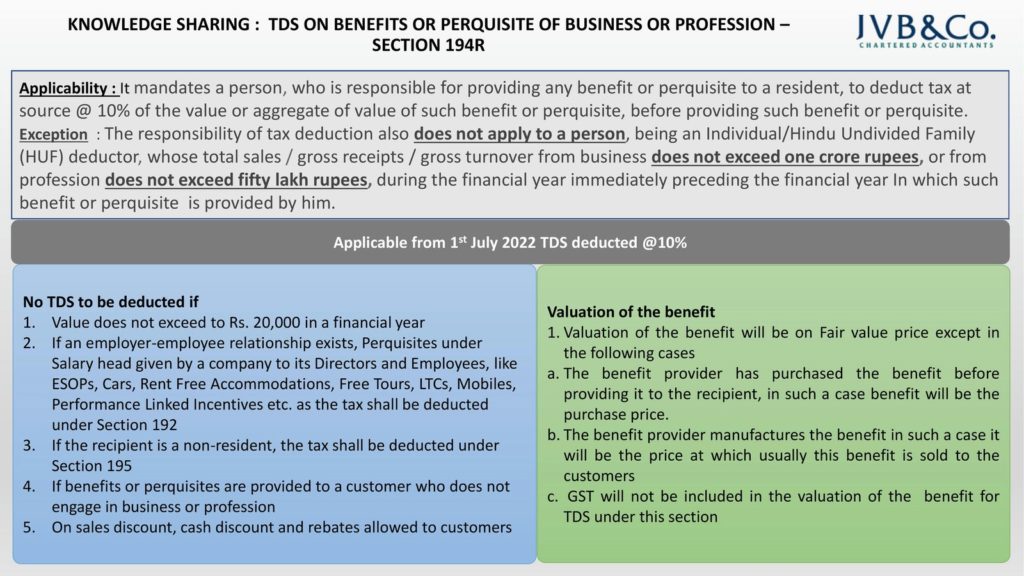

TDS ON BENEFITS OR PERQUISITE OF BUSINESS OR PROFESSION – SECTION 194R

- Applicability : It mandates a person, who is responsible for providing any benefit or perquisite to a resident, to deduct tax at source @ 10% of the value or aggregate of value of such benefit or perquisite, before providing such benefit or perquisite.

- Exception : The responsibility of tax deduction also does not apply to a person, being an Individual/Hindu Undivided Family (HUF) deductor, whose total sales / gross receipts / gross turnover from business does not exceed one crore rupees, or from profession does not exceed fifty lakh rupees, during the financial year immediately preceding the financial year In which such benefit or perquisite is provided by him.