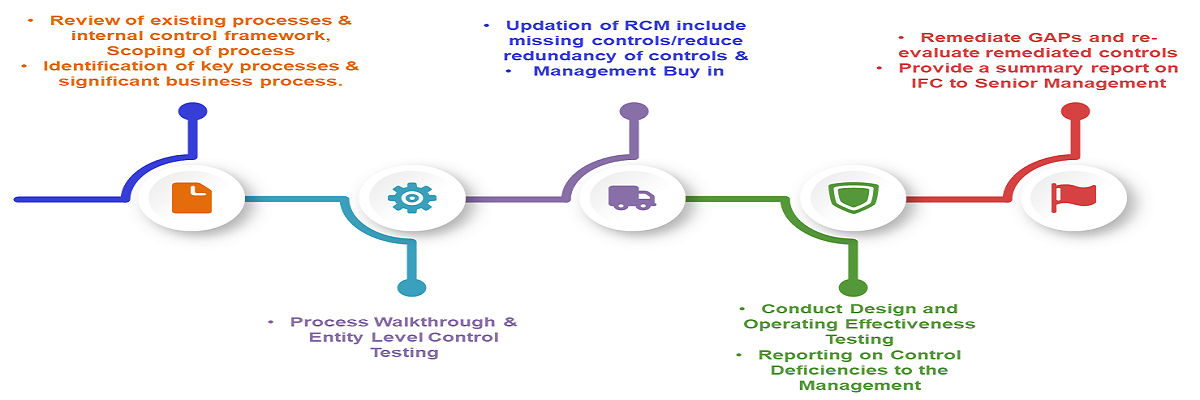

JVB is a trusted partner of Internal Financial Control (IFC) and Internal Control over Financial Reporting (ICOFR) solutions. As a leading IFC audit firm in Mumbai, we specialize in providing comprehensive solutions to help your organization establish robust internal control systems. Our team of highly skilled professionals possesses deep expertise in assessing, designing, and implementing effective IFC and ICOFR frameworks. We understand the critical role internal controls play in safeguarding your assets, ensuring compliance, and mitigating risks. With JVB, you can rely on our meticulous approach, advanced technology, and extensive experience to enhance the efficiency and reliability of your financial operations. Contact us today to strengthen your internal controls and protect your organization’s financial integrity.